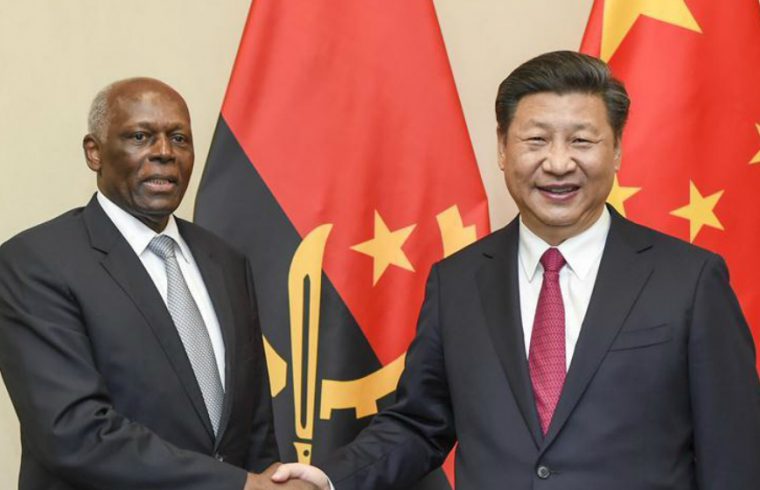

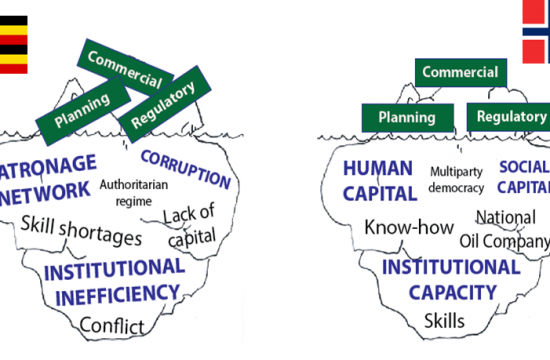

This project is aimed at identifying and analyzing spillover effects of Chinese foreign direct investments (FDI) in selected African countries. The secondary objective is to investigate an effect which has been hinted in the literature but to date has not been properly understood nor systematized, namely “inter-sectoral crowding-in effect”. Those effects will be primarily studied using an economic perspective, but due to a multidimensional nature of China-Africa relations and in order to place the effects in a proper context, the project will employ an interdisciplinary approach, which will involve non-economic factors. The research empirically will be anchored in two case studies, proposed in consultation with the foreign partner – Angola and Zambia. There are two hypotheses to be tested in the project. The main hypothesis is: specific features of the Chinese FDI in Africa make spillover effects (in economic sense) limited in scope, on the contrary spillover effects may be observed with a great intensity in the political and social areas. The secondary hypothesis reads as: the inflow of Chinese FDI to the extractive sector brings about inter-sectoral crowing-in effects.